Overview

Why post-login dashboards are important?

Instantpay’s post-login area is where merchants manage services like payments, loans, marketplace, and connected banking—all from a central workspace designed to handle daily business operations.

role and Outcome

Led the process from identifying core problems to ideating solutions, crafting high-fidelity mockups, and building the final prototype. The modules are now live and in use.

Context

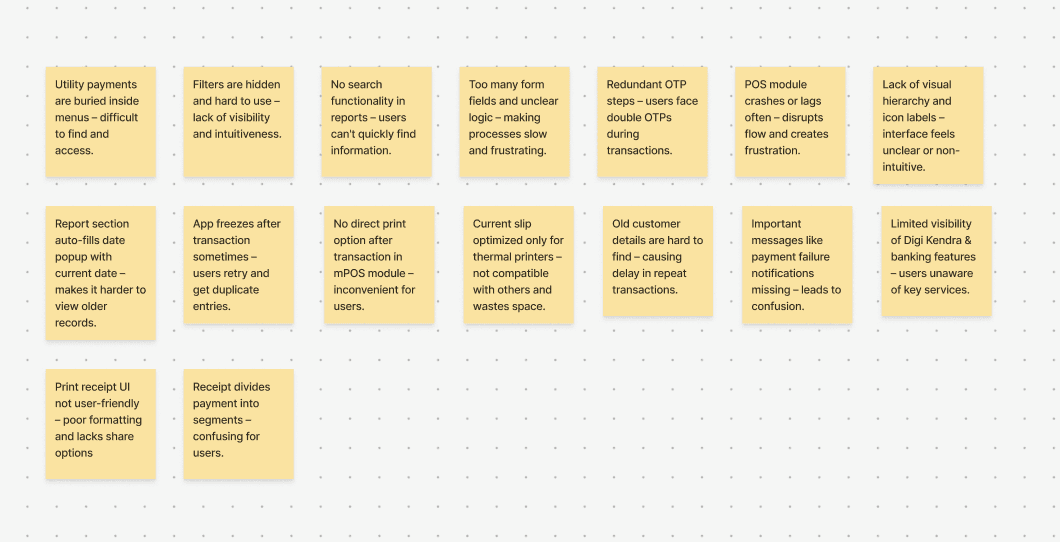

Understand the problem

The design team started by conducting user interviews to uncover key issues across the platform. In 2024, I collaborated with them on various modules, focusing on enhancing the user experience by creating a cleaner, simpler, and more intuitive interface.

user insights

Product study

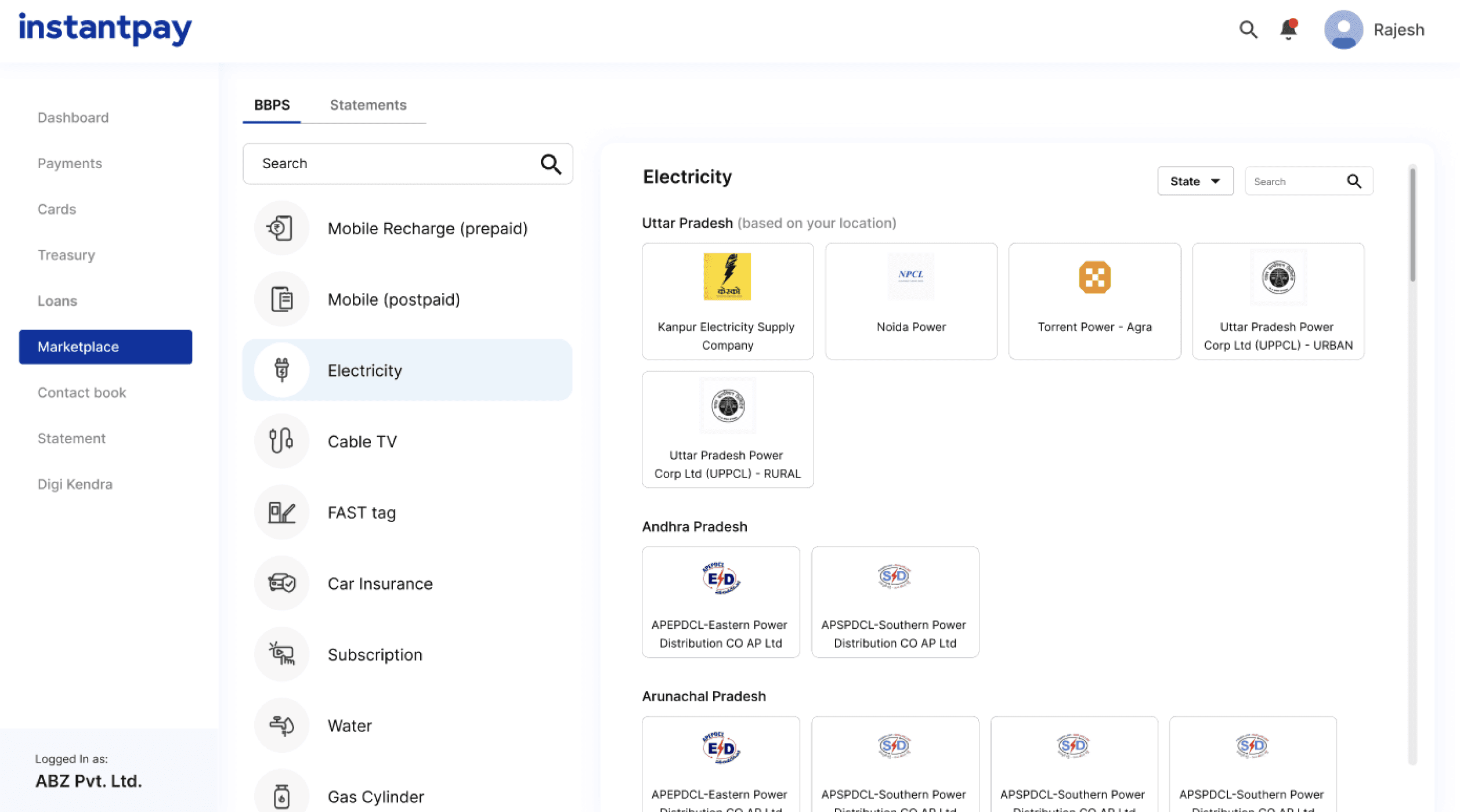

marketplace module

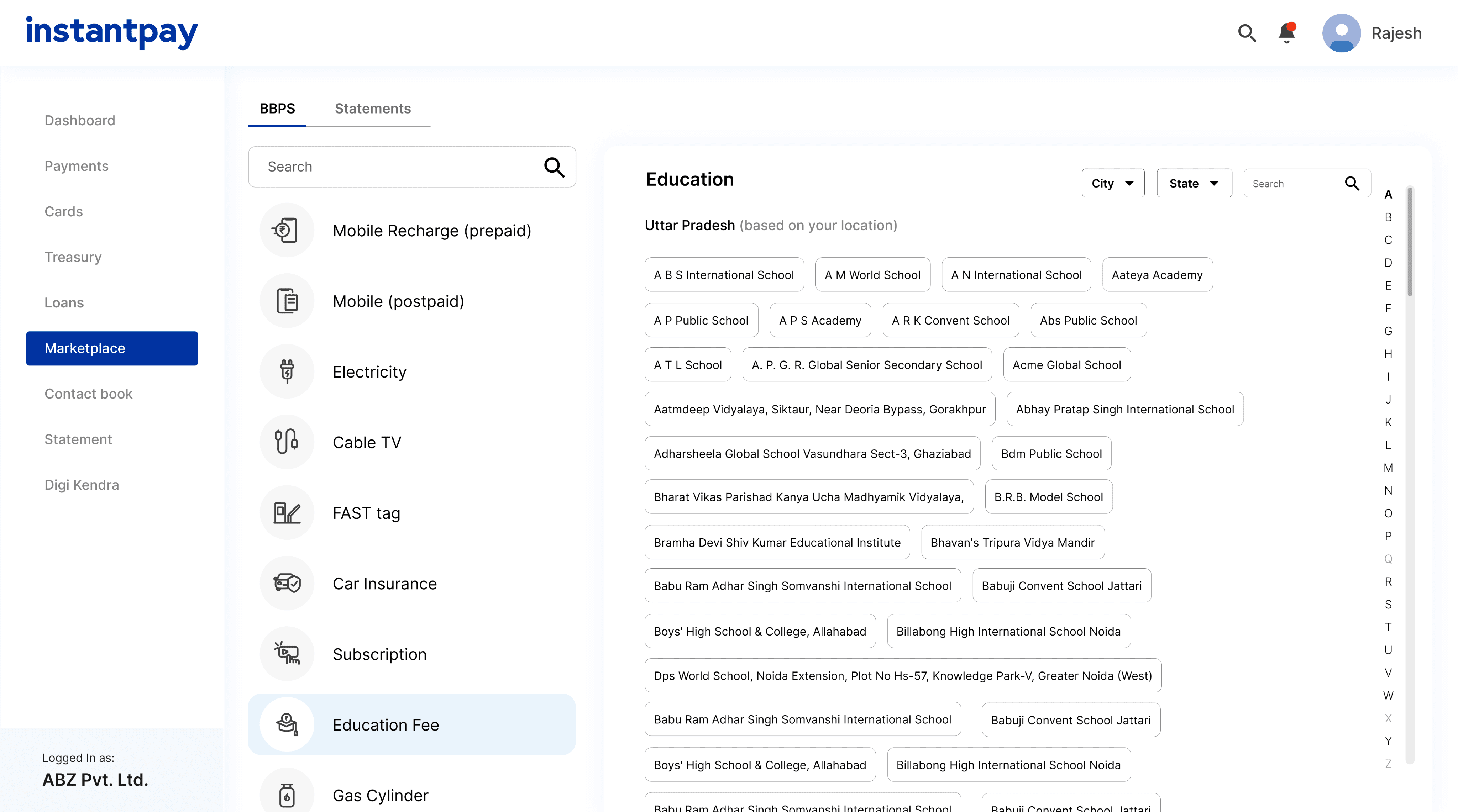

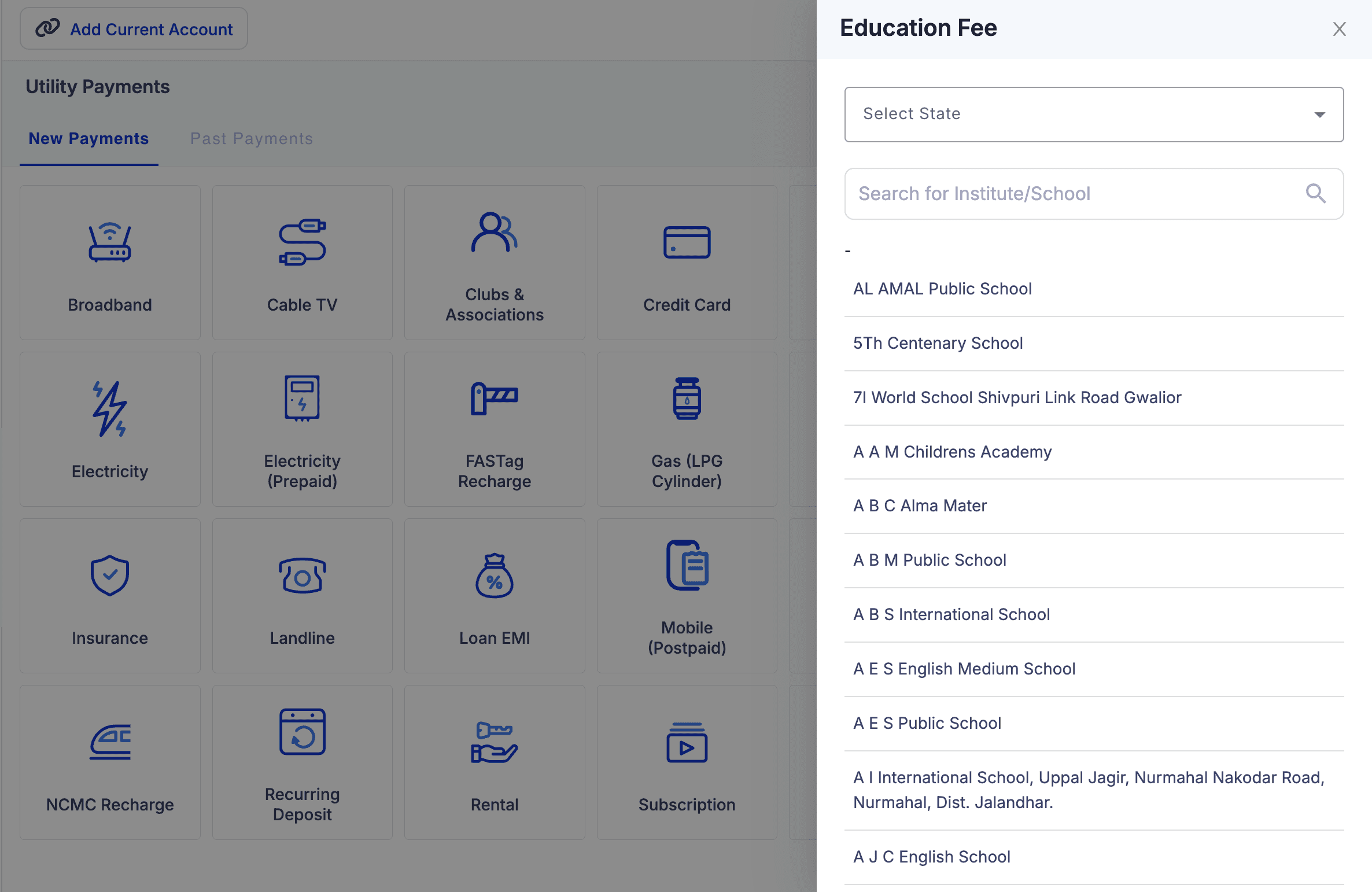

The Marketplace module acts as a one-stop hub for retailers to access a wide range of utility and bill payment services. This module includes:

Bill Payments: Enables retailers to easily pay utility bills like electricity, water, gas, and mobile recharges for their customers.

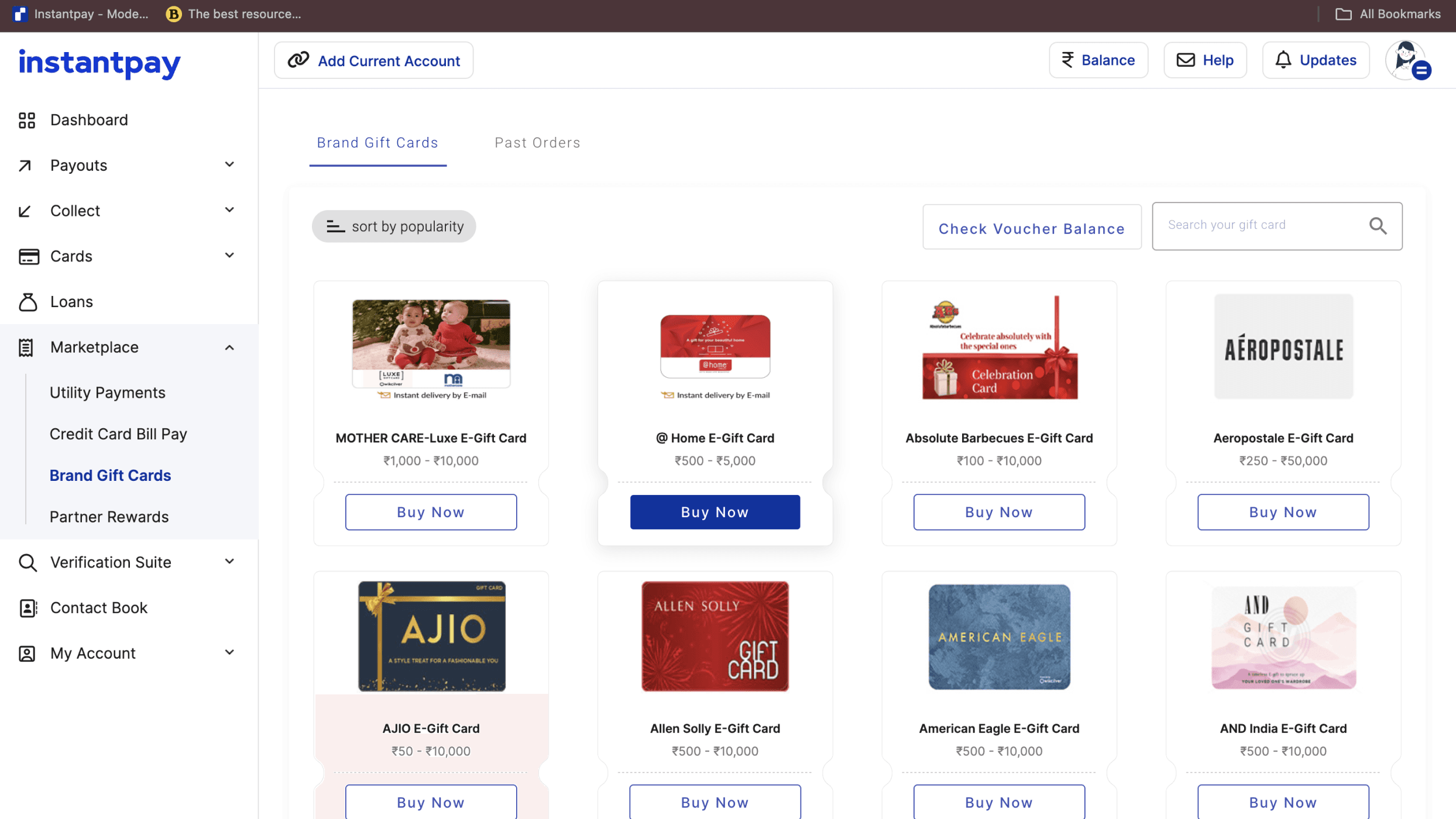

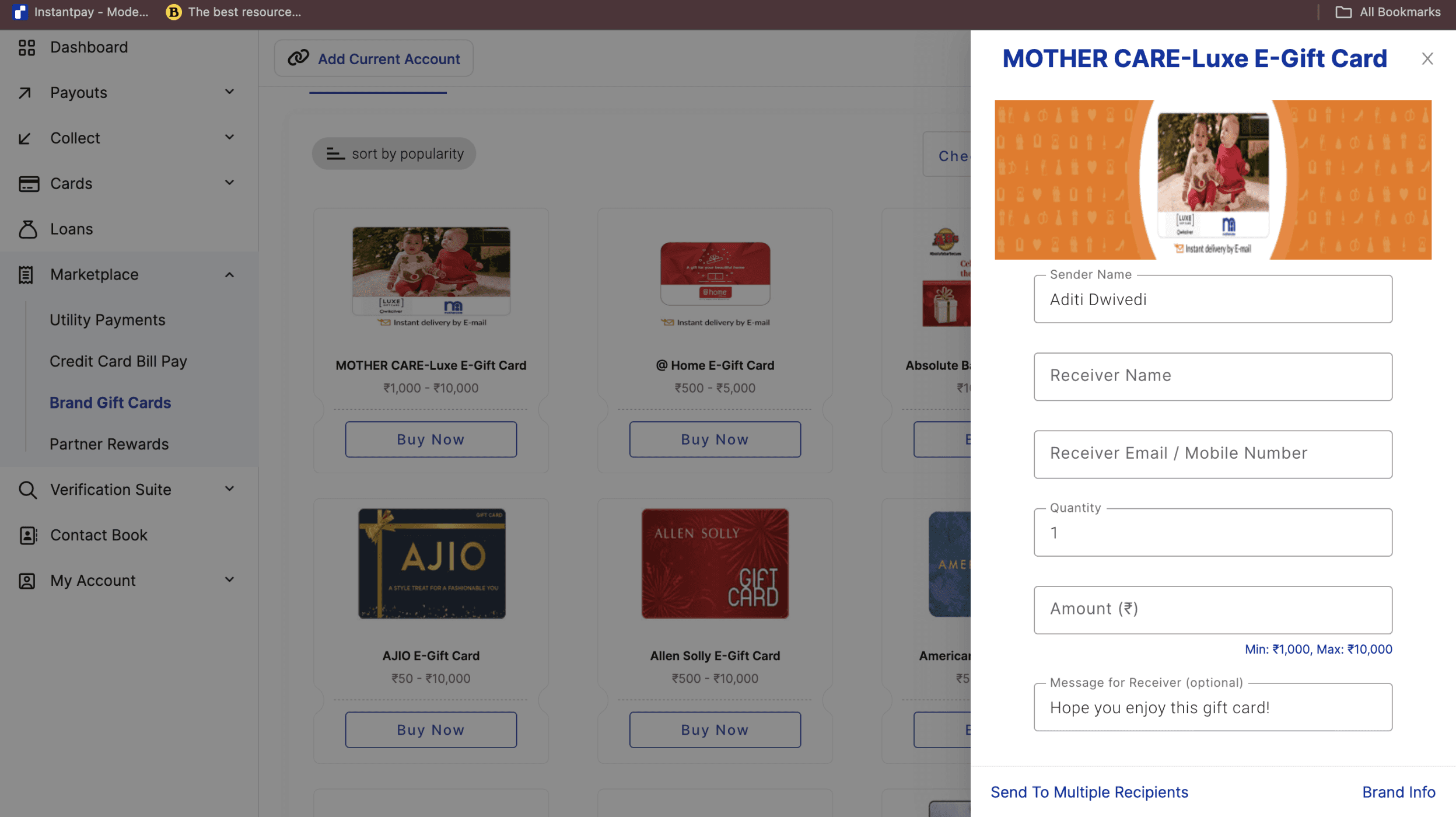

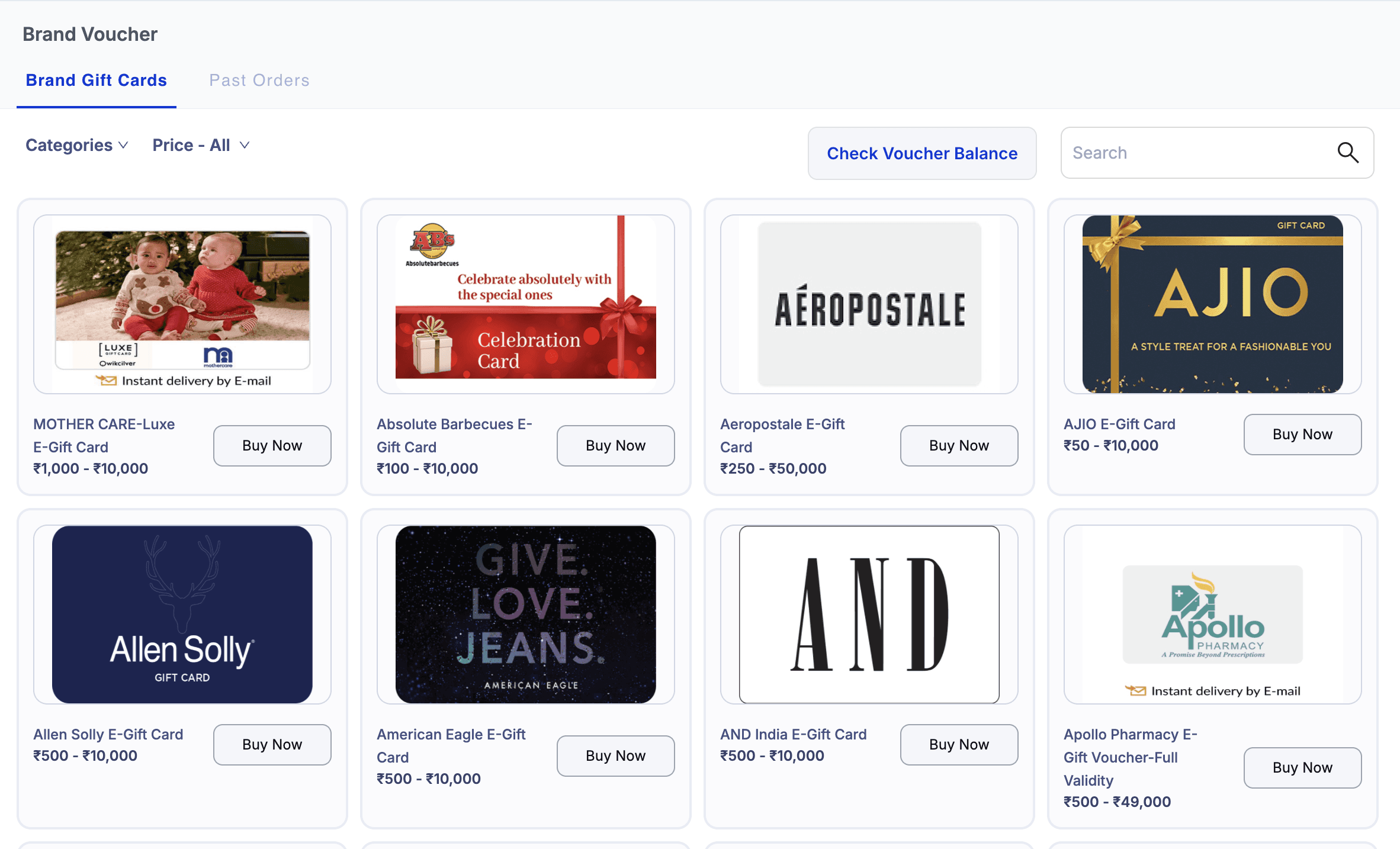

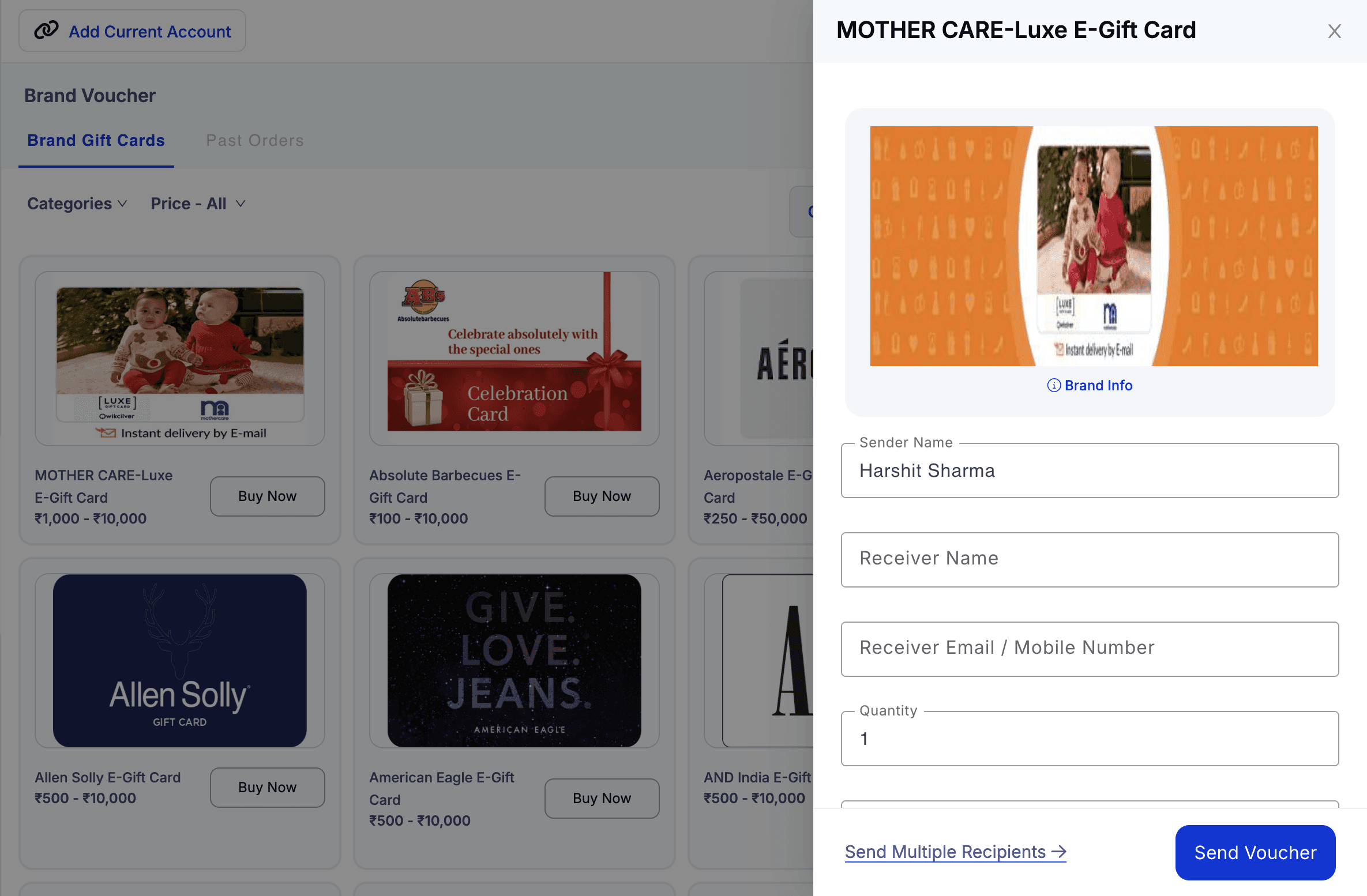

Brand Gift Cards: Allows users to purchase digital gift cards from popular brands for resale or personal use.

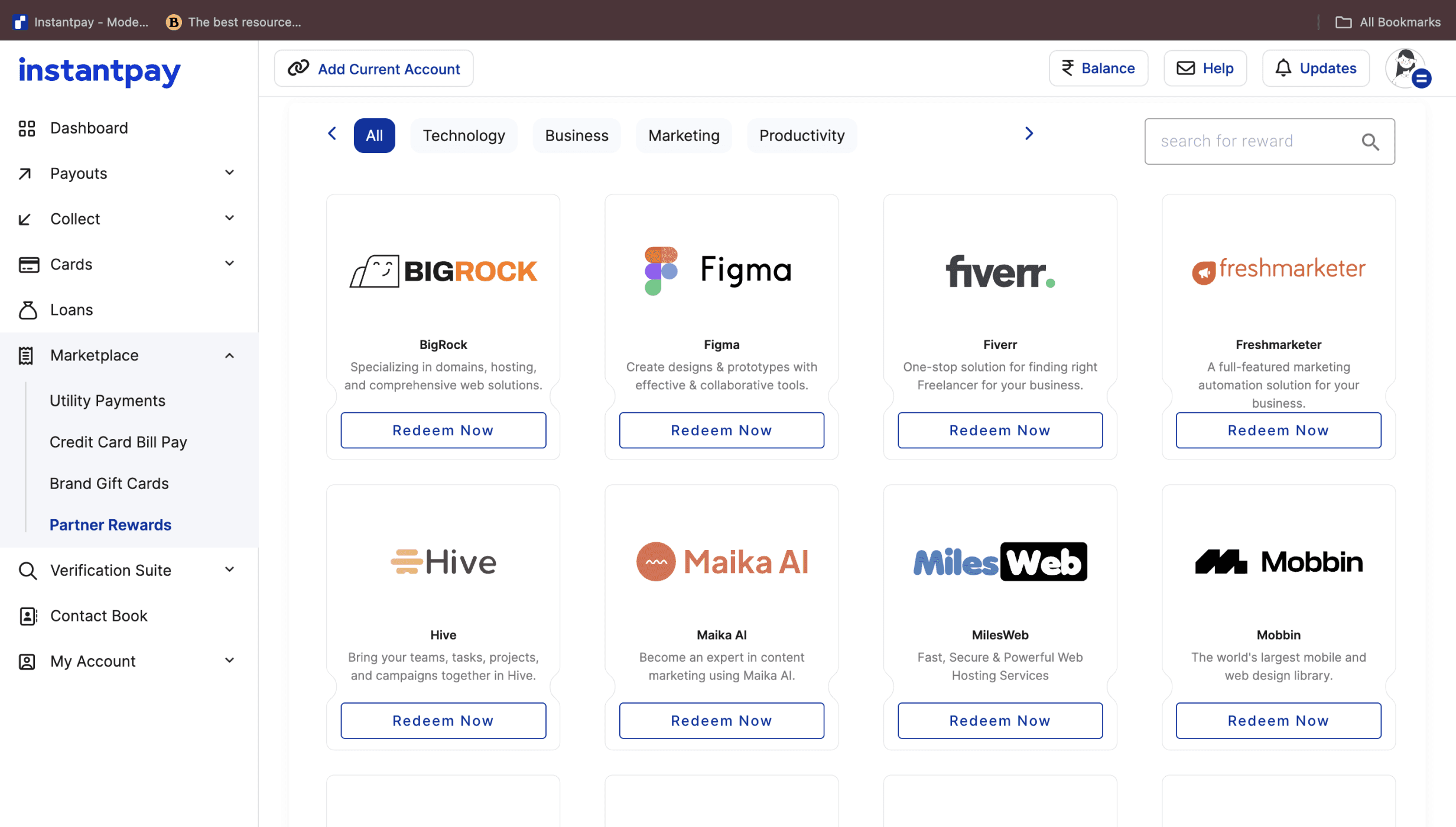

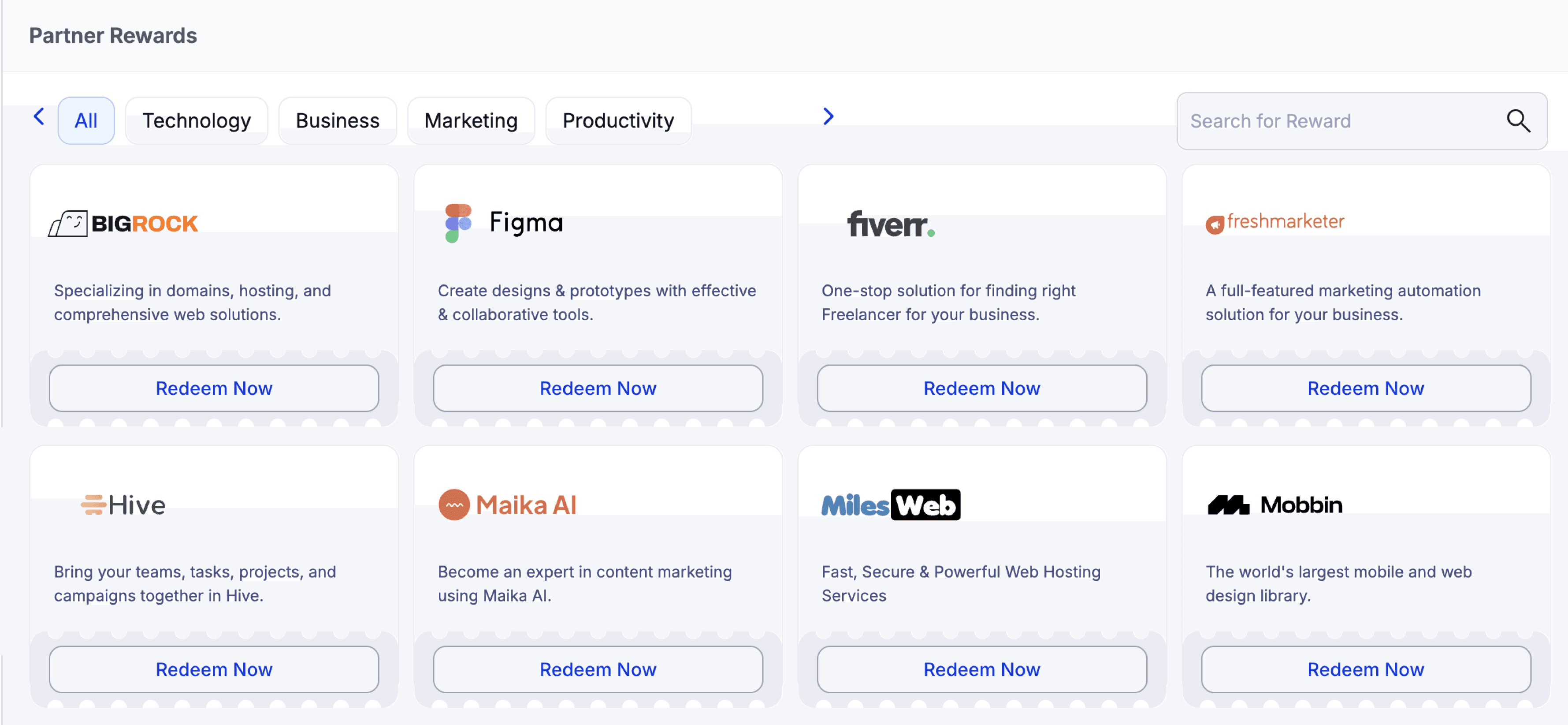

Partner Rewards: Offers cash-back, commission, or rewards.

Bill Payments

Brand Gift Cards

Partner Rewards

“Among the many modules I worked on, this one walks through the entire redesign journey”

Users are shown too much information at once, without clear structure, making it hard to focus or make quick decisions.

Users have to scroll through a long list to access all services, which affects ease of navigation and discoverability."

No sort or filter options are available, making it hard for users to find or organize information, especially with large data sets.

The design appears visually dull and lacks polish, which impacts the overall user experience and lowers the perceived quality of the interface.

No brand information is shown, making it harder for users to trust or choose the right product.

After outlining the product scope, the process kicked off with competitive research to better understand industry standards and opportunities

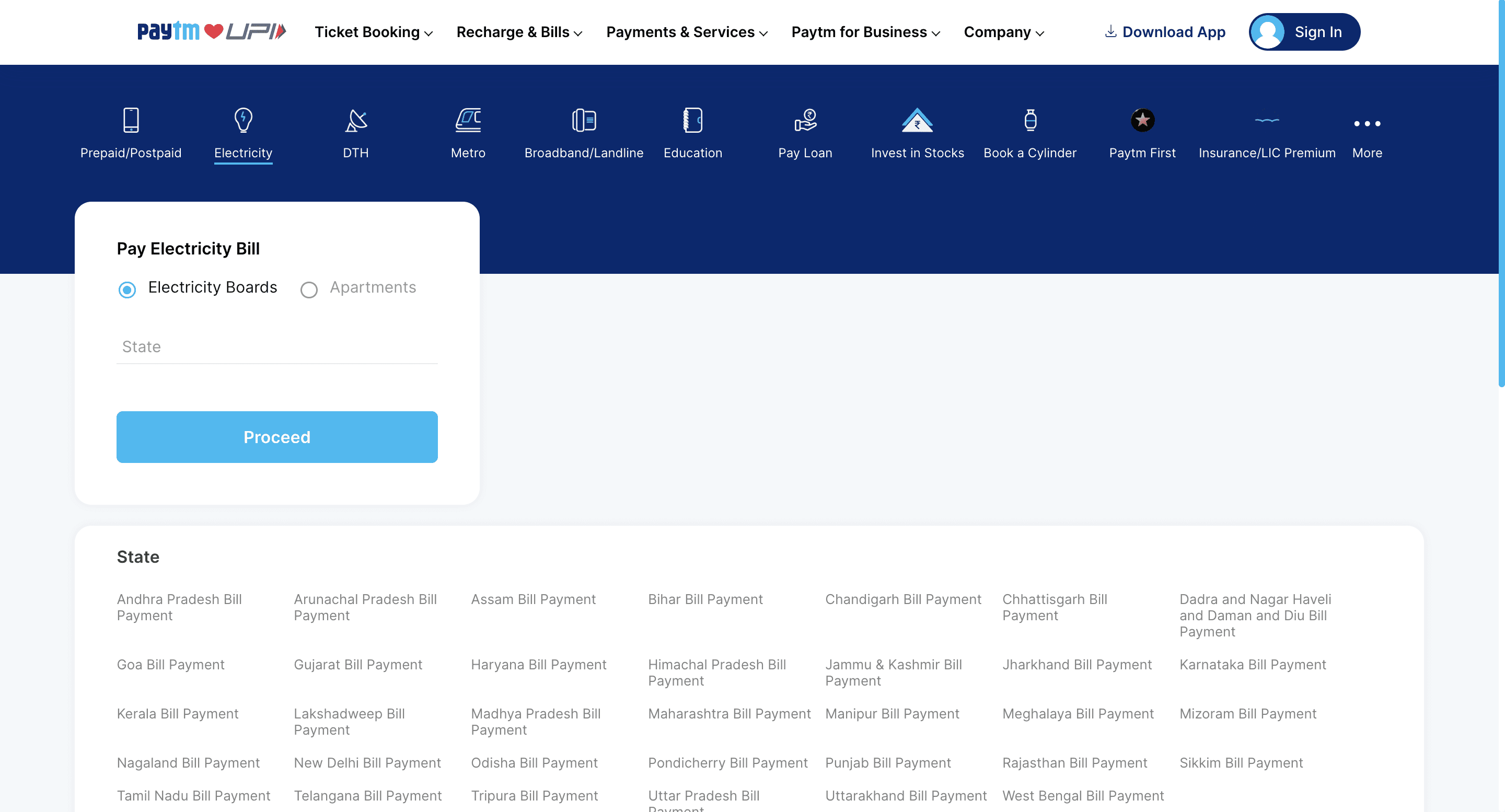

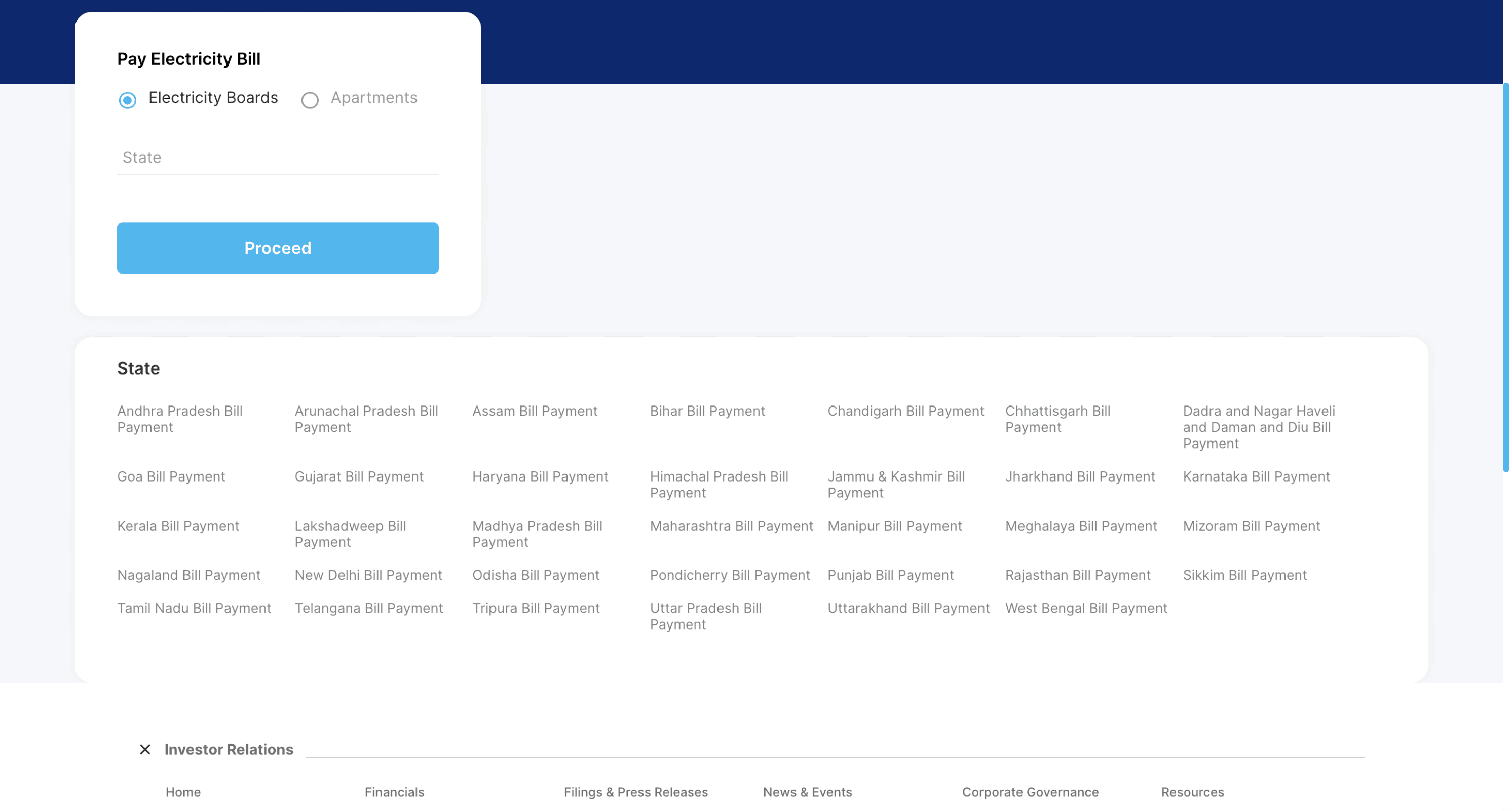

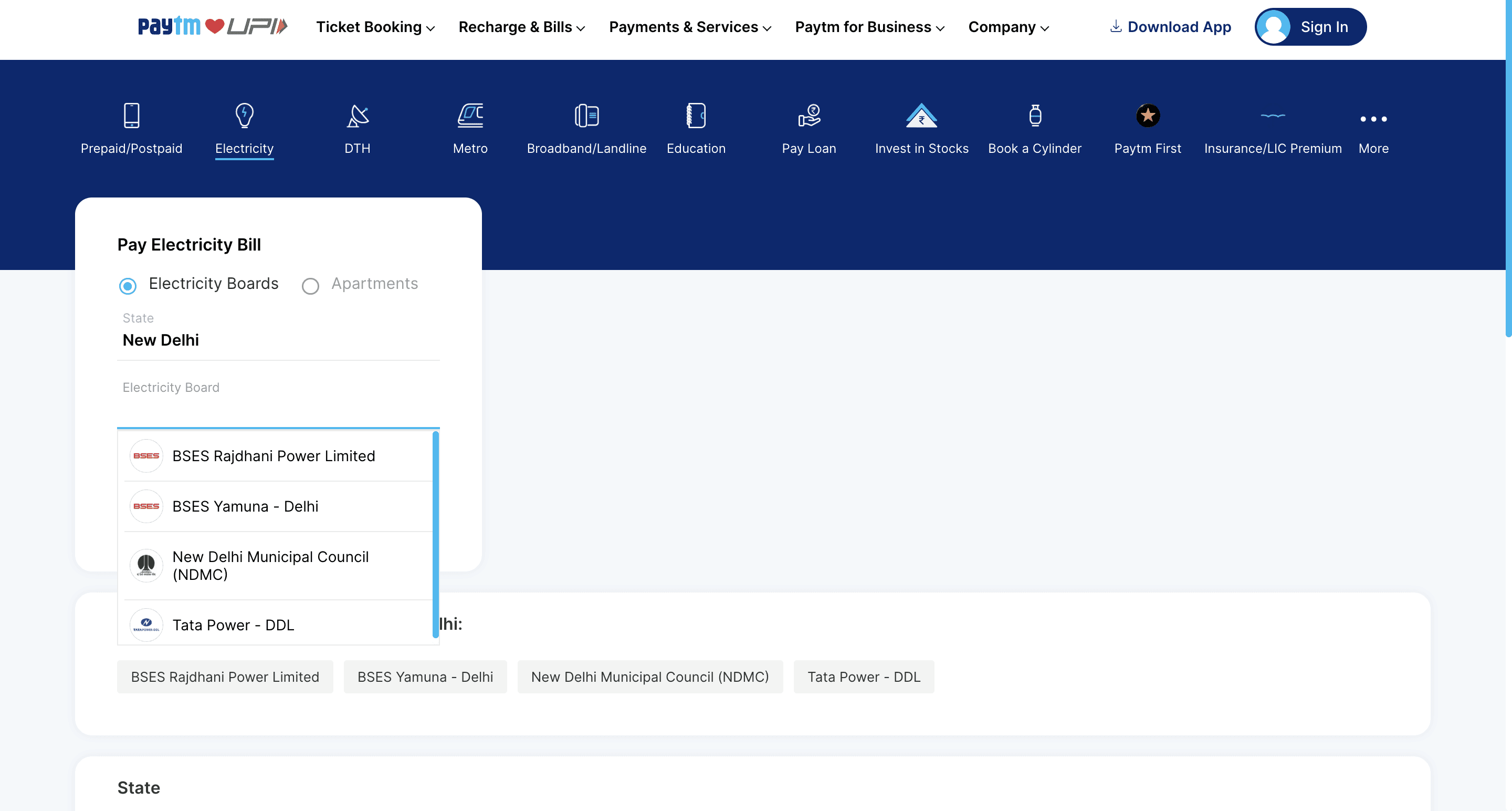

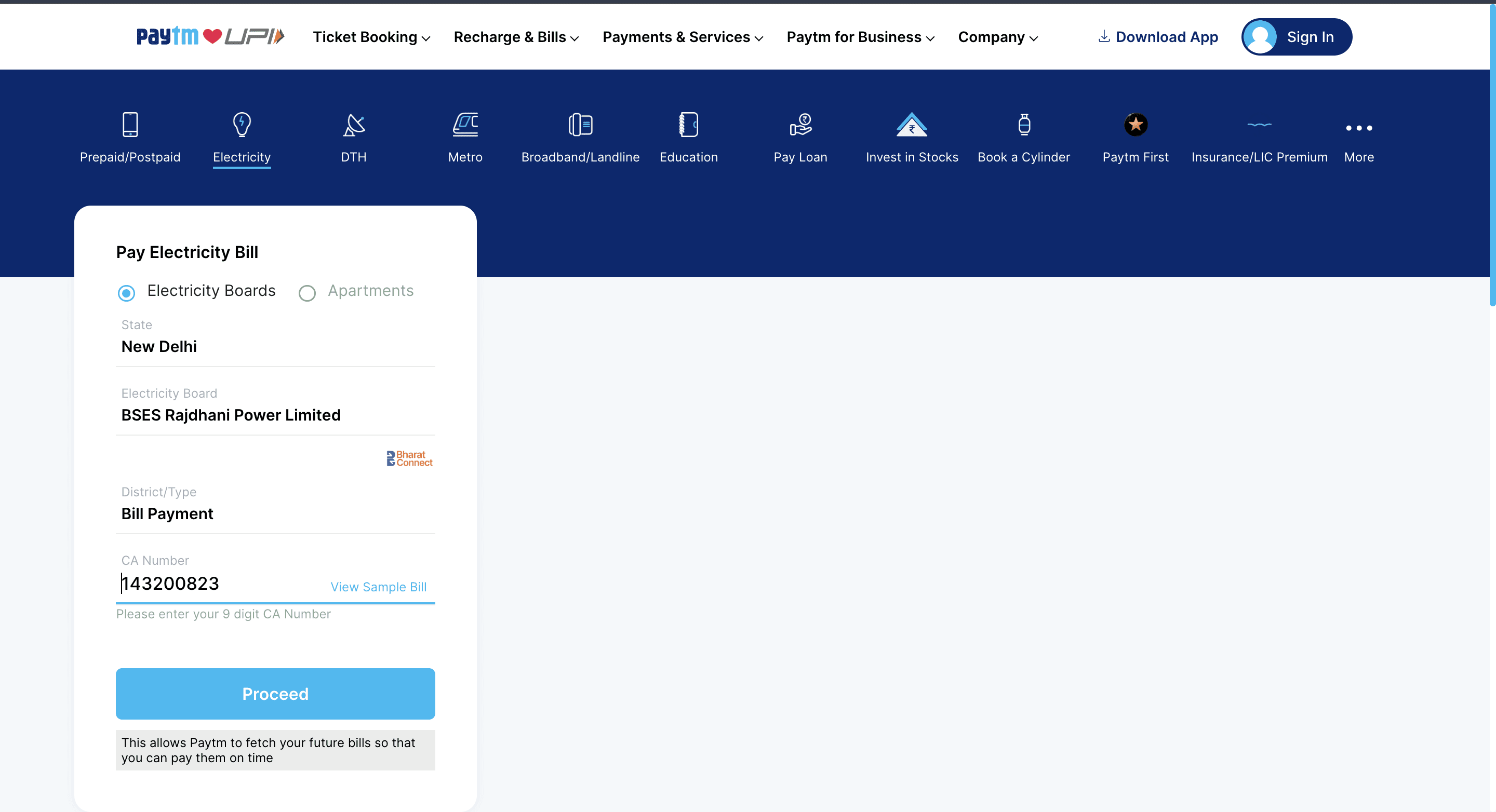

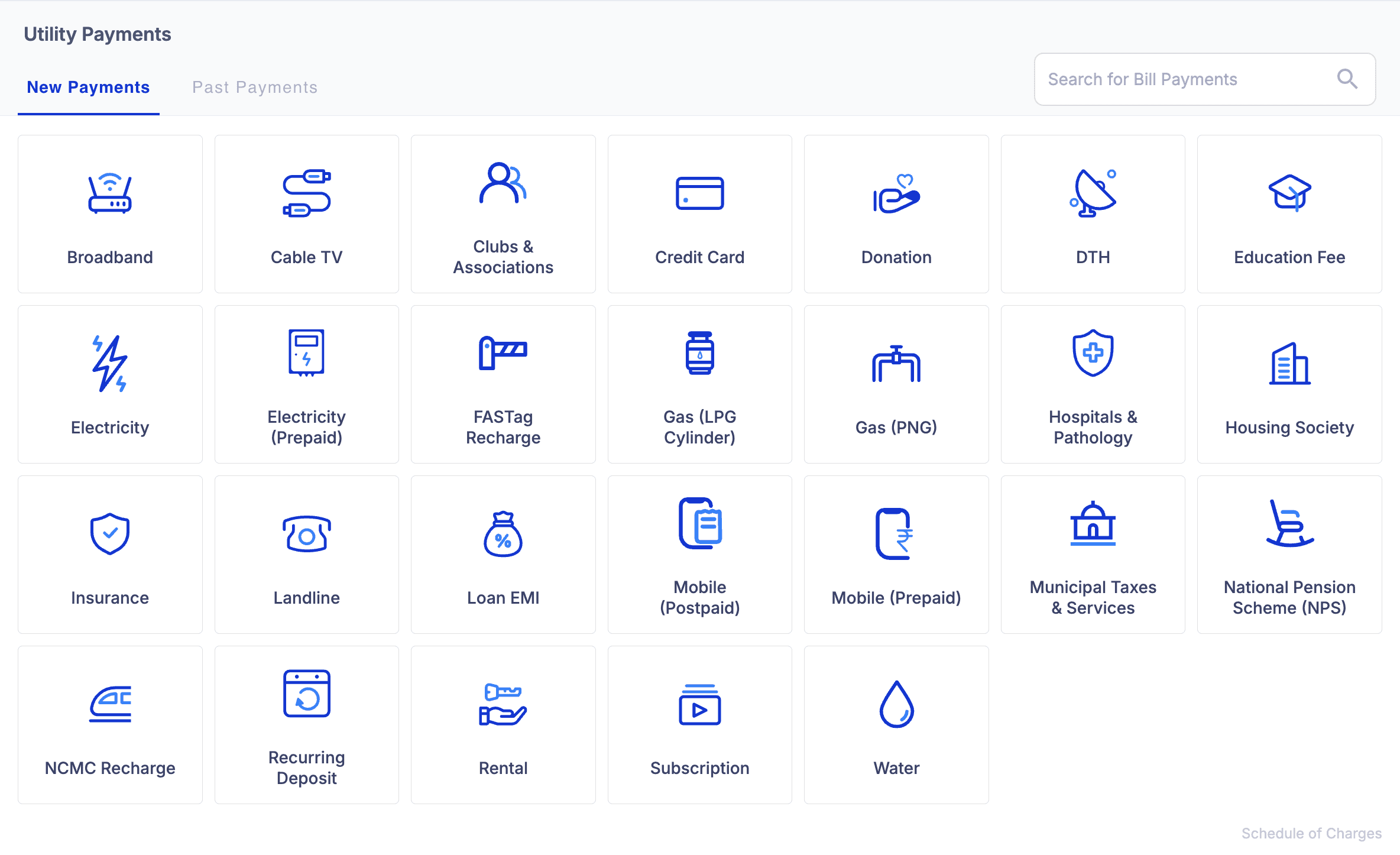

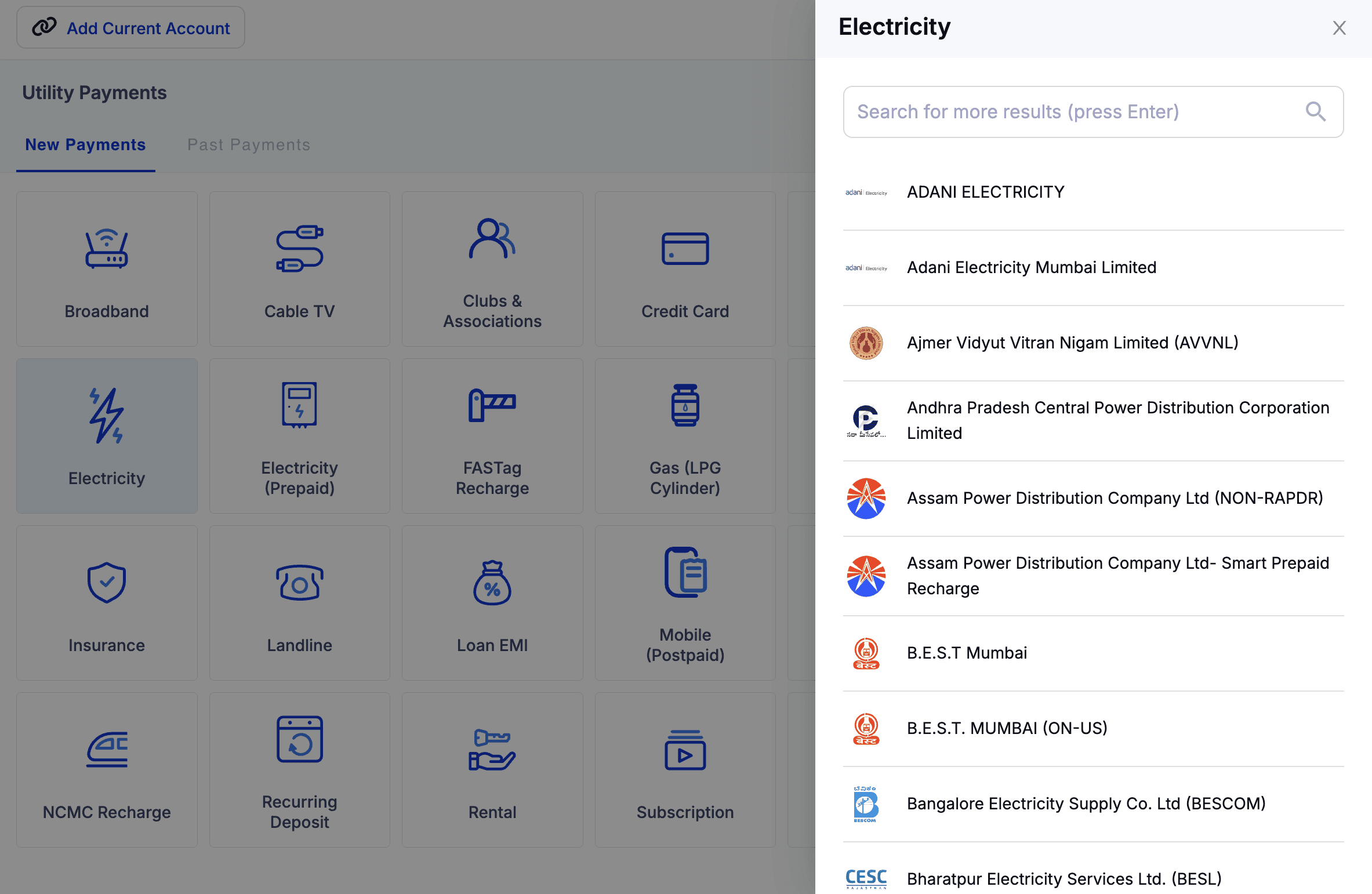

UTILITY bill payments - paytm

The interface provides a clear and minimal starting point with a focused CTA, making it easy for users to begin the bill payment process.

Listing all states upfront improves visibility and helps users quickly identify their region without needing to scroll or search extensively.

The dropdown with logos and clear naming supports quick recognition and selection, enhancing decision-making speed and confidence.

The structured layout with logical field progression makes the form easy to fill, and the contextual help improves usability.

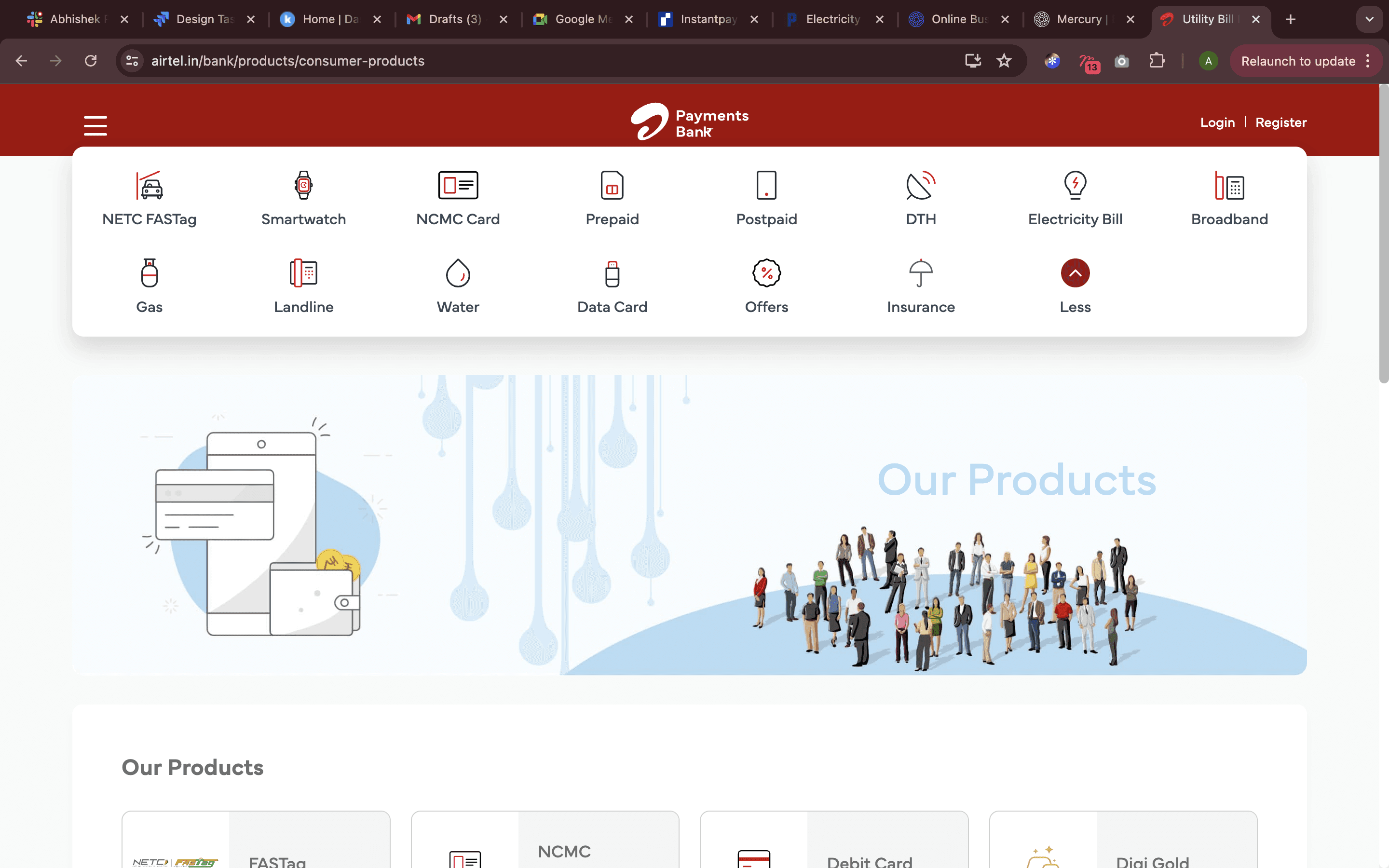

Airtel payments

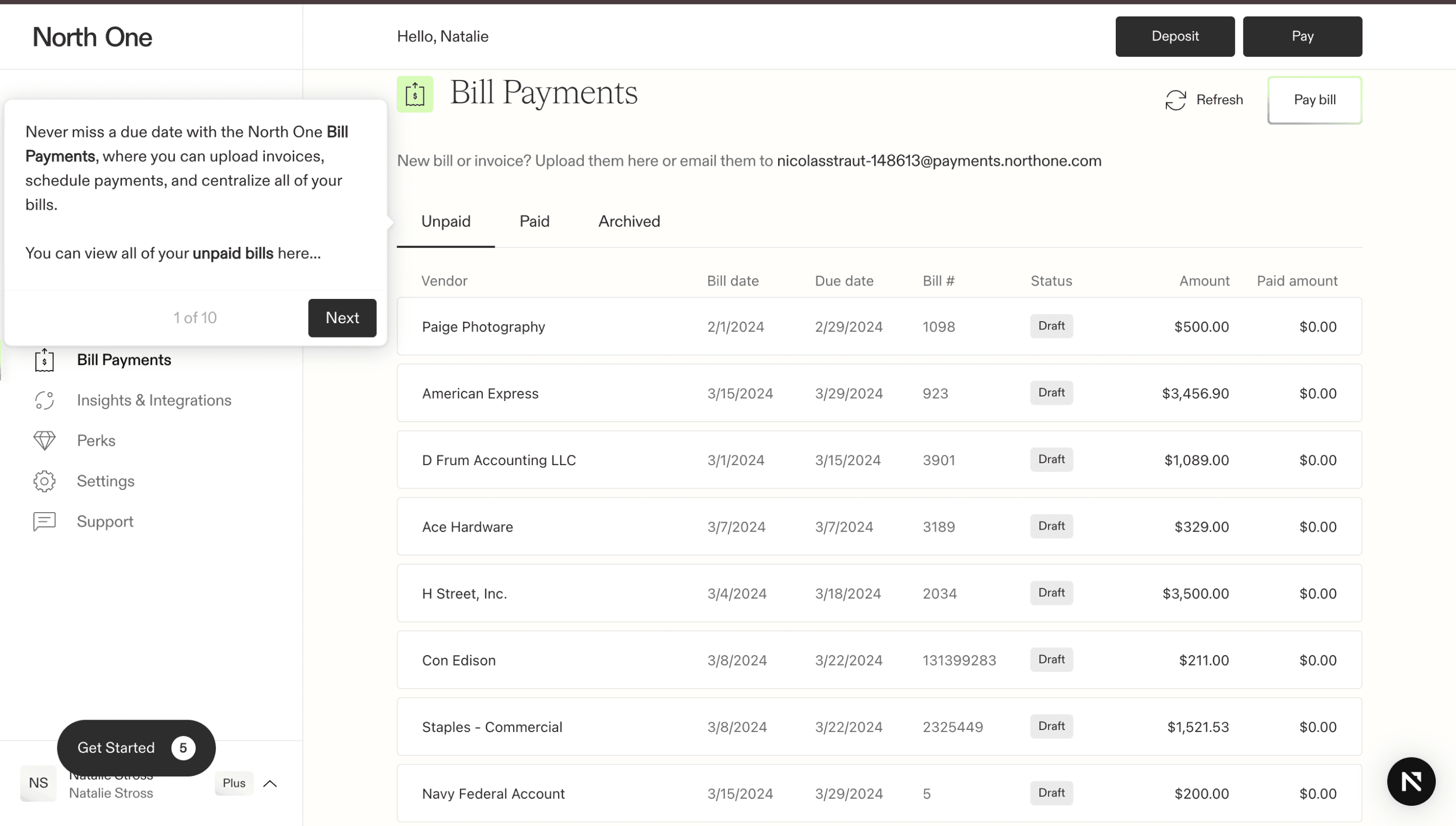

North one

The clean and minimal dashboard design improves visual clarity and facilitates easy navigation across services.

Icons and labels are clear and familiar, making it easy for users to understand and quickly access different bill categories.

The dropdown neatly organizes many services, allowing users to explore all options without leaving the main page.

PROBLEM STATEMENT

How might users manage and navigate post-login services effortlessly, without feeling lost in scattered dashboards or complex flows?

MY APPROACH

To ensure easy navigation of post-login services, the interface should be intuitive, streamlined, and well-structured—with clear categories, minimal clutter, and quick access to key actions for efficient task completion.

Solution

utility payments

The categories are prominently displayed, allowing users to view all options at a glance without the need to scroll.

The layout is well-structured, with clearly organised sections that guide the user smoothly through the interface, making navigation simple and straightforward.

Separate search fields for state and school name are provided, allowing users to find what they need easily without jumping between different sections.

Brand gift cards

Well-defined sort and filter options are available, enabling users to easily narrow down brand vouchers by category and price range.

Brand information is clearly provided, helping users make informed choices and building trust by ensuring transparency and credibility in the offerings.

partner rewards

The overall visual design has been enhanced to capture the user's attention more effectively, using improved layout, colors, and imagery to create a more engaging and appealing experience.

Other Pages

mPOS

The mPOS module enables merchants to accept digital payments through mobile-based point-of-sale systems. It supports seamless card and QR transactions, enhancing flexibility for on-the-go businesses.

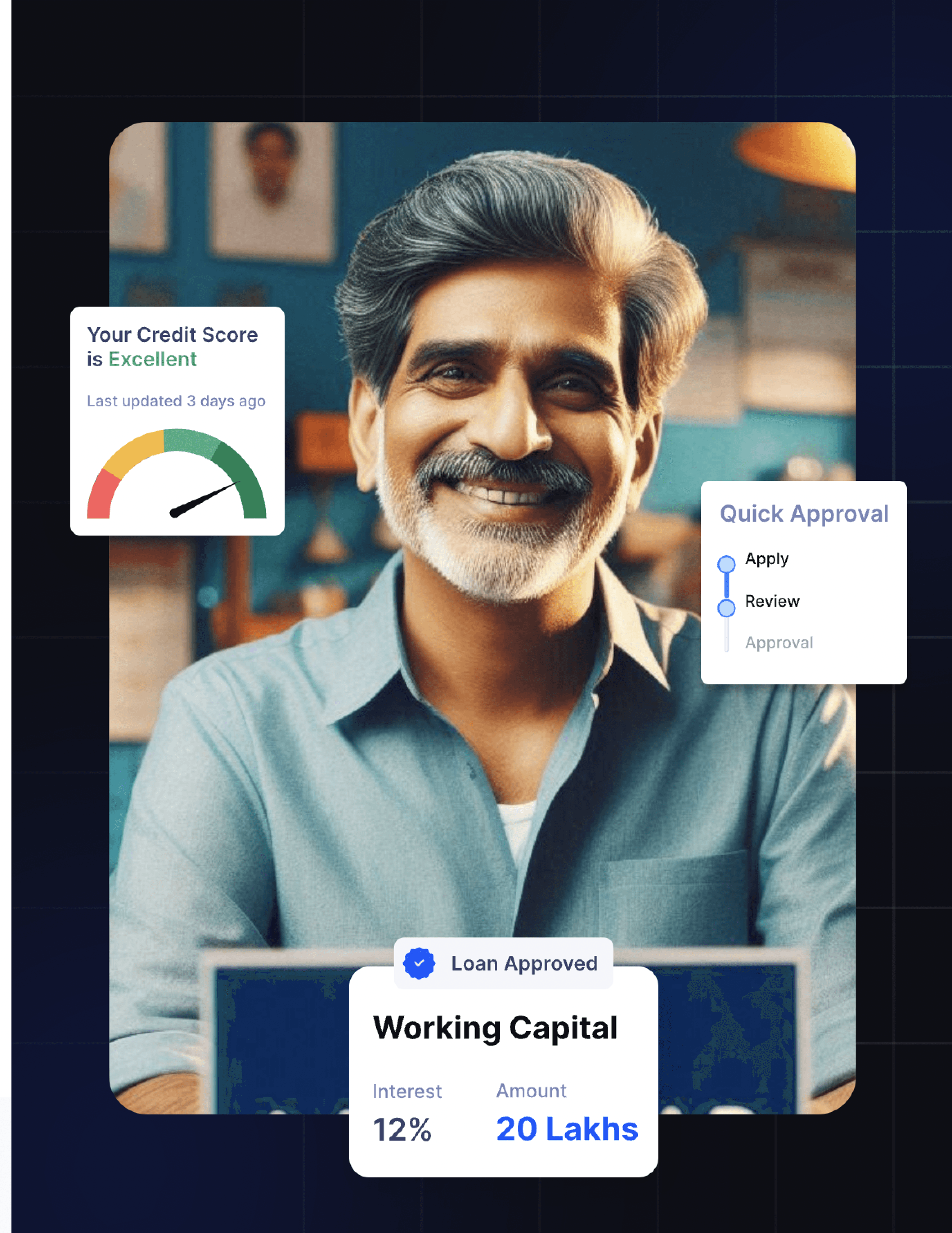

Loans

The Loans module provides merchants with access to short-term credit and working capital solutions. It offers easy application, transparent terms, and real-time loan tracking within the platform.

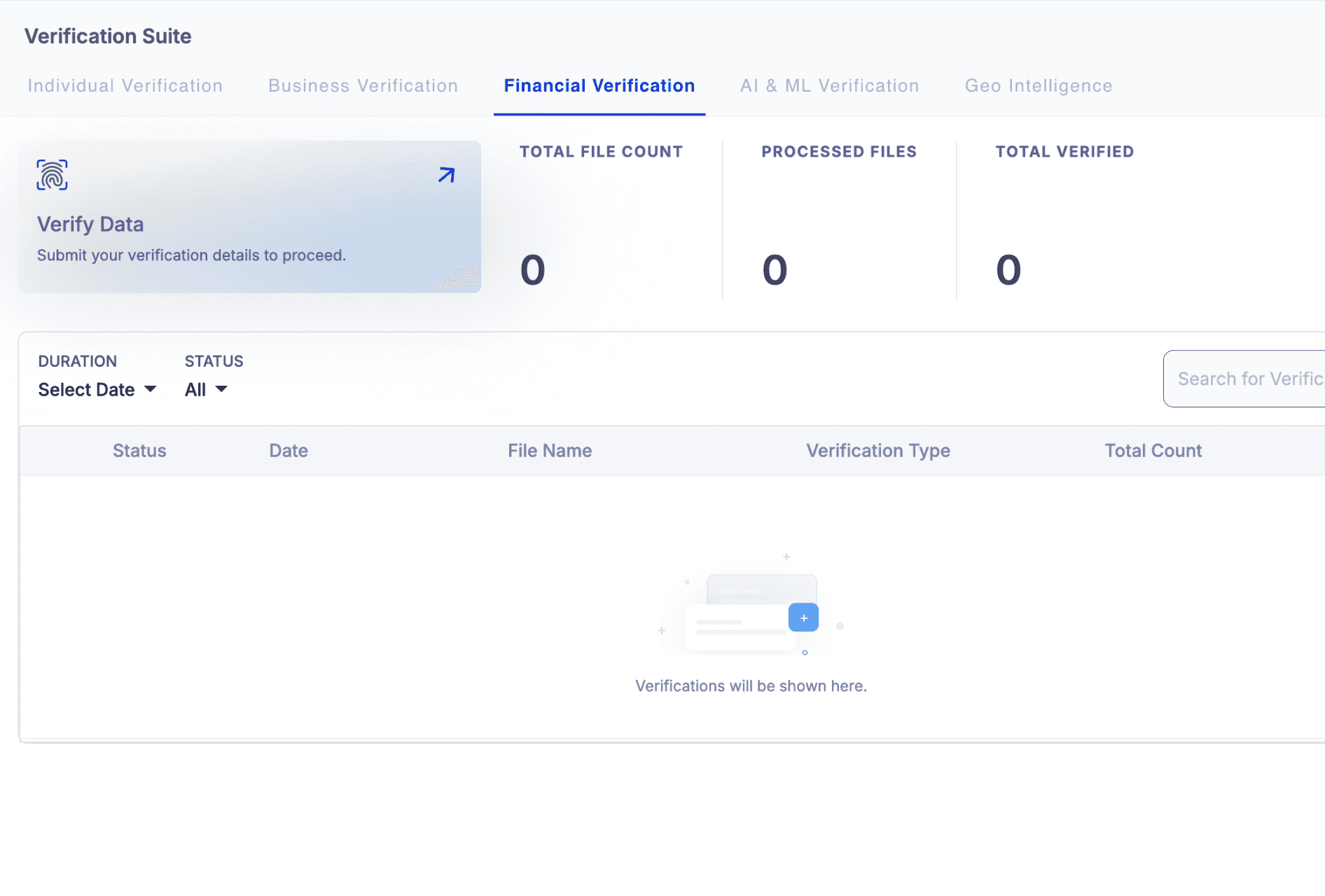

Verification Suite

The Verification Suite allows merchants to authenticate identities, documents, and businesses with speed and accuracy. It integrates KYC, Aadhaar, PAN, and other verifications into a single unified flow.

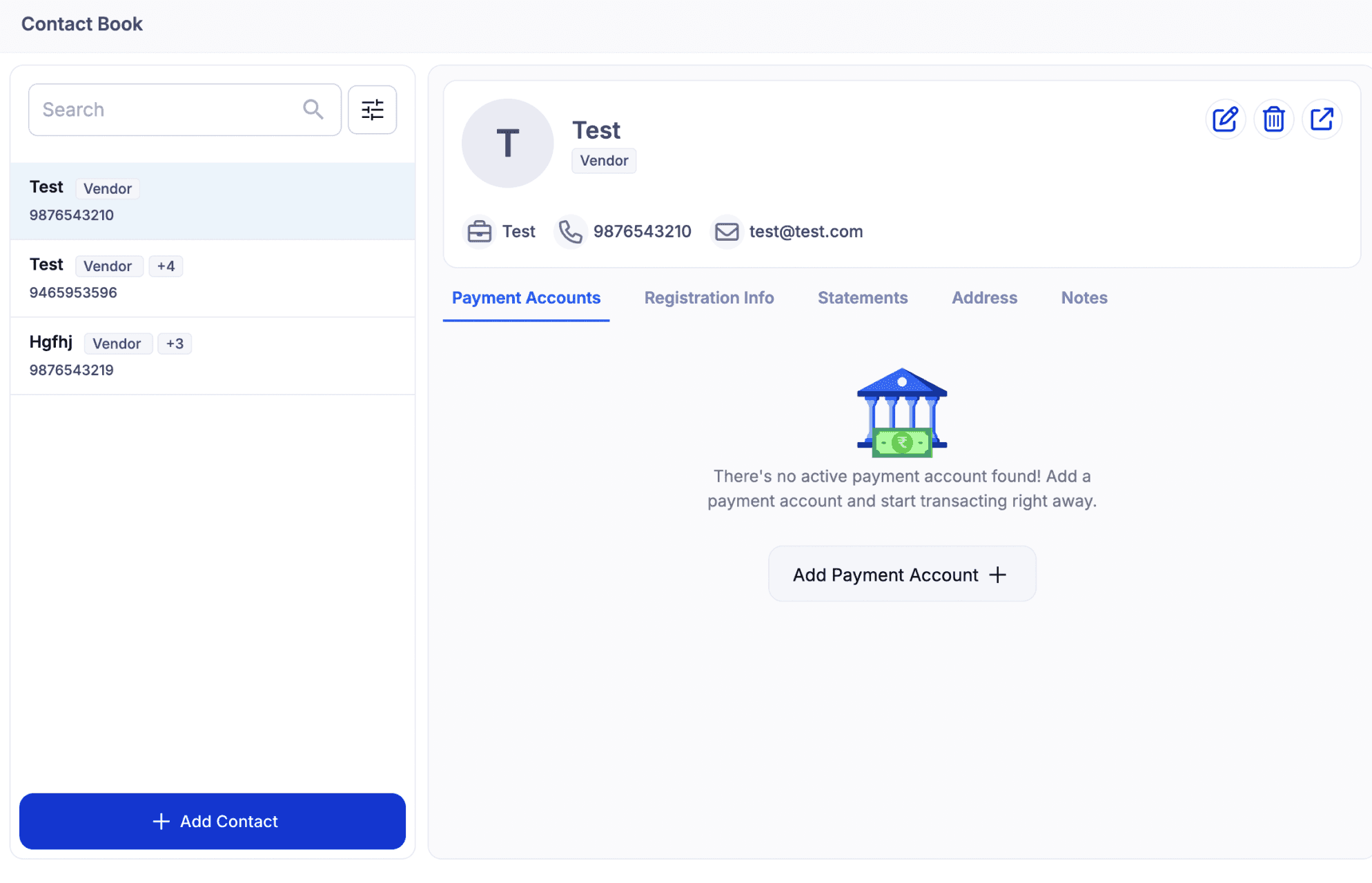

Contact Book

The Contact Book module helps users manage, store, and quickly access frequently used customer or business contacts. It streamlines repeat transactions by linking contacts with their associated services.